Prior year depreciation calculator

It takes the straight line declining balance or sum of the year digits method. Sum-of-Years Digits Depreciation Calculator Calculate depreciation for any chosen period and create a sum of years digits method depreciation schedule.

Macrs Depreciation Calculator Based On Irs Publication 946

This limit is reduced by the amount by which the cost of.

. Based on Excel formulas for SYD. Depreciation Calculator The following calculator is for depreciation calculation in accounting. Our car depreciation calculator uses the following values source.

Formula for Calculating Depreciation Rate of Depreciation Original Cost Residual Value Useful Life 100. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. Since you cannot claim more depreciation than the costvalue of the vehicle when you began using it you are limited to that number when reporting the saledisposal.

All you need to do is. Depreciation Expense Book value of asset at beginning of the year x Rate of Depreciation100 Depreciation Calculator. However if you have depreciated this property on prior year tax returns you would enter the total Accumulated Depreciation as of the end of last year as the amount of Prior.

The calculator makes this calculation of course Asset Being Depreciated -. To calculate prior depreciation for multiple assets follow the steps below. If you are using the double declining balance method just select declining balance and set the depreciation factor to be 2.

It is fairly simple to use. First year depreciation 12-M05 12 Cost. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Section 179 deduction dollar limits. The calculator also estimates the first year and the total vehicle depreciation. Use the compute option when adding the asset to let the Asset Management application calculate the depreciation expense for any prior periods in the current fiscal year.

MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. The basic way to calculate depreciation is to take the cost of the asset minus. If you are in UltraTax CS open the Asset tab.

How is depreciation calculated as per Companies Act 2013 PDF. D i C R i Where Di is the depreciation in year i C is the original purchase price or. June 3 2019 1048 AM Yes enter the total original value of the vehicle in both the Prior Depreciation and AMT Prior Depreciation boxes.

Select the currency from the drop-down list optional Enter the. Depreciation is a method for spreading out deductions for a long-term business asset over several years. Depreciation in Any Full year Cost Life Partial year depreciation when the property was put into service in the M-th month is taken as.

Perform the steps in this procedure to compare the application-calculated prior depreciation amounts with the amounts entered in the assets Prior Depreciation fields. With this method depreciation is calculated equally. It provides a couple different methods of depreciation.

This depreciation calculator is for calculating the depreciation schedule of an asset. First one can choose the straight line method of depreciation. Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full 12 months and is a number M months the first and last years will be.

0 Reply tombom89 New Member. After a year your cars value decreases to 81 of the initial value. Use our 2022 Section 179 calculator to quickly calculate potential depreciation on qualifying business equipment office furniture technology software and other business items.

This simple depreciation calculator helps in calculating depreciation. If you are in Fixed Assets CS continue to Step 2. After two years your cars value.

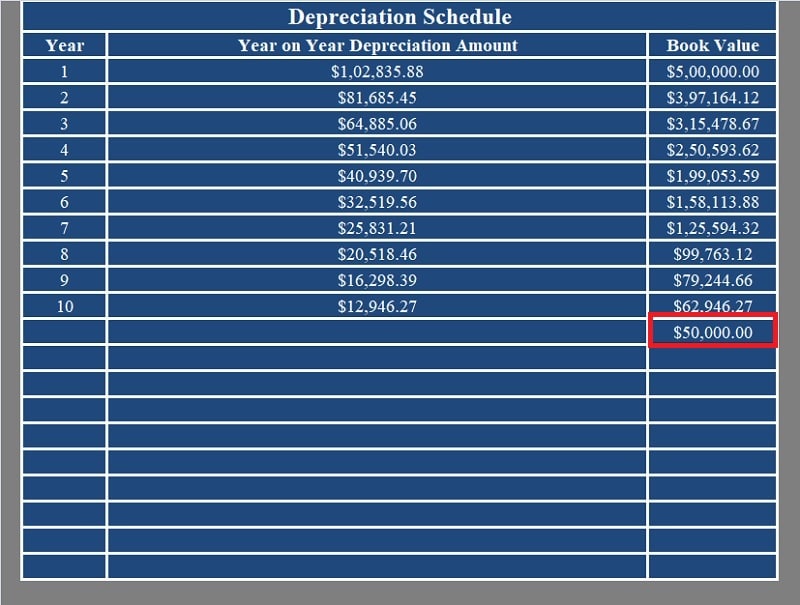

Depreciation Schedule Formula And Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Declining Balance Depreciation Calculator

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Methods Principlesofaccounting Com

Depreciation Schedule Formula And Calculator

Free Macrs Depreciation Calculator For Excel

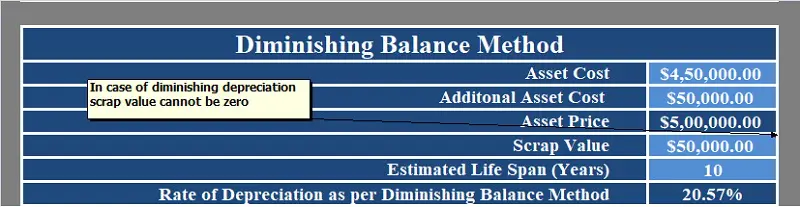

Declining Balance Method Of Depreciation Formula Depreciation Guru

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Irs Publication 946

Download Depreciation Calculator Excel Template Exceldatapro

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Formula And Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Calculator Definition Formula

Depreciation Schedule Formula And Calculator